Creative Content

Written Content That Works

Creating Authentic Consumer Engagements

Audiences are always adapting and their needs change. It is essential to keep your content fresh and relevant to continue to excite your audience. Updating your digital and print content with edits, restructuring and upgrading relevant content is proven to improve a user’s experience with your brand. We evaluate, strategize, create, and optimize your content to help you connect to your customer.

Are you looking for beautifully written pages, product descriptions, blog posts, search engine optimized text or bold headlines – we’ve got the talented team that can handle it for you!

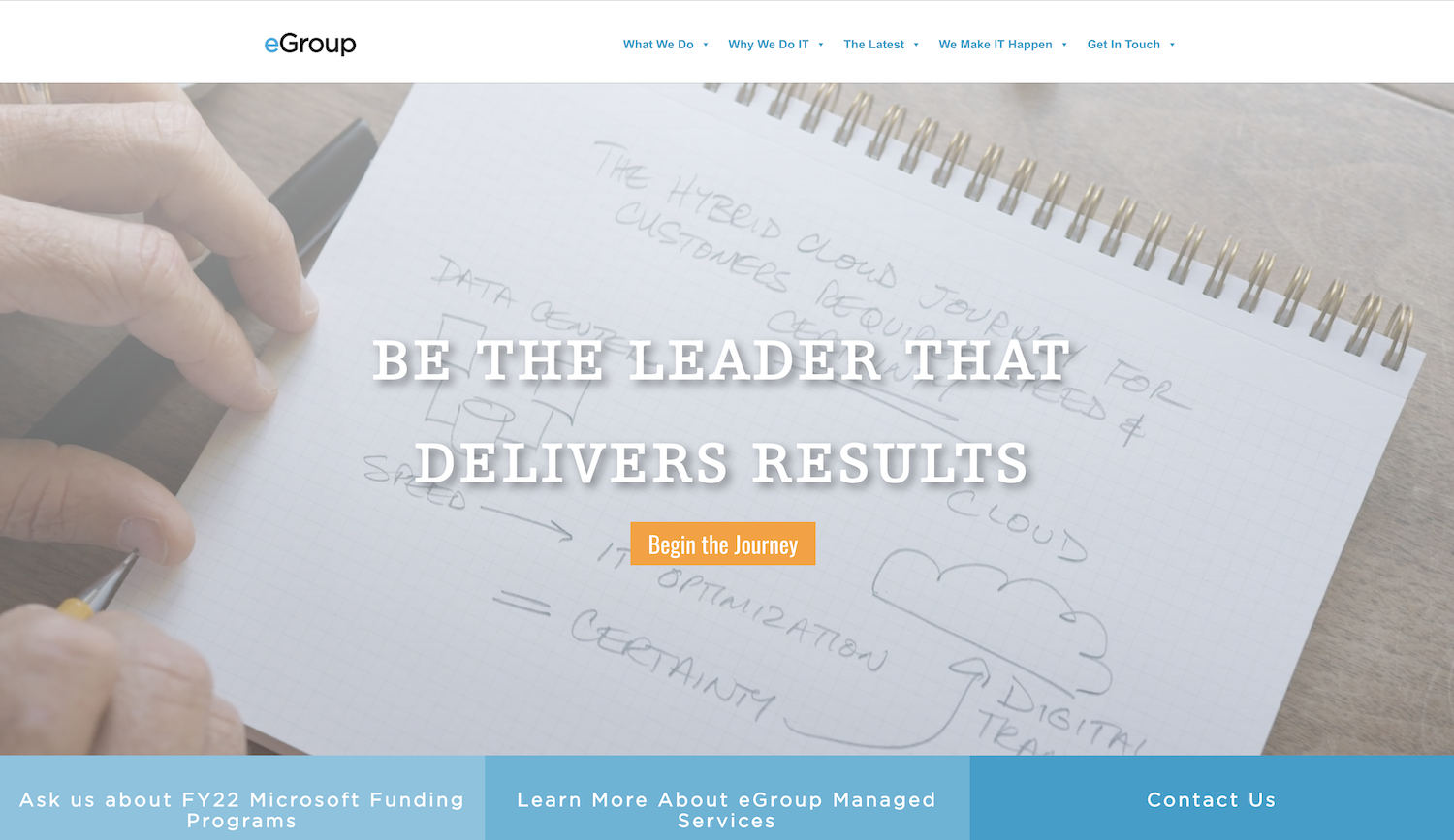

We build website content that creates an excellent impression on readers. With ever-changing website expectations and customer behavior, we will keep you ahead of the competition by giving your brand an authentic and searchable voice.

SEO-Focused Website Content

Not only will it leave a great impression on your web visitors, but great content also boosts your content marketing efforts which improves your search engine rankings. Long-term organic ranking strategies are achieved through quality content and will attract more quality traffic. People will feel a more authentic connection with your brand if you appear organically, rather than through a promoted ad.

Newsletters

Newsletters are an effective way to stay top-of-mind to the audience that already knows your business. Keeping in touch with relevant content is extremely important to your business. King and Columbus creates expertly designed and written newsletters that increase traffic, engagement, and customer loyalty.

Content Audit

We measure the performance of your content and your current SEO ranking. From there, we create a content strategy to express your brand’s voice. Updating and adding content is the foundation of building a strong online brand.

Native Content

Reach target customers and generate leads across desktop and mobile with native content. Content that looks and feels like the purchaser’s brand can help you engage a new audience.

Additional Resources

Interested in taking your company's marketing to the next level?

Shop Our Content

We offer a variety of custom magazines throughout the year. You can use the sections within your own publication, or as one-off stories. This content is great for newsletters, local magazines, websites, flyers – the possibilities are endless. Once it’s purchased, it’s all yours.

Content Calendar

Our 2022 Content Calendar provides a new topic for each month of the year. This content is designed to connect your customer to your business through content.

Subscribe to Newsletter

Interested in learning more about industry trends or how our agency can help grow your business?